The 45-Second Trick For Offshore Trust Services

Wiki Article

9 Easy Facts About Offshore Trust Services Explained

Table of ContentsThe Basic Principles Of Offshore Trust Services The Only Guide to Offshore Trust ServicesThe Definitive Guide to Offshore Trust ServicesThe Facts About Offshore Trust Services UncoveredThe Best Guide To Offshore Trust ServicesThe Ultimate Guide To Offshore Trust ServicesThe Main Principles Of Offshore Trust Services What Does Offshore Trust Services Do?

Private creditors, even bigger exclusive companies, are extra amendable to resolve collections versus borrowers with difficult and reliable possession defense strategies. There is no property security strategy that can discourage a highly encouraged creditor with unrestricted cash and perseverance, yet a well-designed overseas trust often gives the debtor a desirable negotiation.Trustee companies bill annual charges in the series of $1,000 to $5,000 per year plus per hour rates for added services. Offshore trusts are except everybody. For lots of people residing in Florida, a domestic possession defense plan will certainly be as efficient for a lot less money. But for some individuals facing hard lender troubles, the offshore depend on is the very best choice to safeguard a considerable amount of properties.

Debtors might have much more success with an overseas count on strategy in state court than in an insolvency court. Judgment financial institutions in state court lawsuits may be intimidated by offshore asset security depends on as well as might not seek collection of possessions in the hands of an overseas trustee. State courts do not have jurisdiction over offshore trustees, which suggests that state courts have limited remedies to purchase compliance with court orders.

Unknown Facts About Offshore Trust Services

A bankruptcy borrower should surrender all their properties and also legal interests in building any place held to the insolvency trustee. An U.S. insolvency court may force the bankruptcy debtor to do whatever is required to transform over to the bankruptcy trustee all the borrower's possessions throughout the globe, including the borrower's beneficial rate of interest in an offshore trust fund.Offshore asset defense trusts are less effective versus Internal revenue service collection, criminal restitution judgments, and also family members sustain obligations. The courts may try to oblige a trustmaker to liquify a trust fund or bring back depend on properties.

The trustmaker must be ready to surrender lawful rights as well as control over their trust possessions for an offshore trust fund to successfully safeguard these properties from U.S. judgments. 6. Choice of a professional and also trusted trustee that will certainly defend an overseas trust is more vital than selecting an offshore count on jurisdiction.

About Offshore Trust Services

Each of these nations has depend on statutes that are favorable for offshore property security. There are refined legal distinctions amongst offshore trust fund jurisdictions' legislations, yet they have much more attributes in usual.

Authorities data on depends on are tough to come by as in many offshore territories (and also in many onshore jurisdictions), trust funds are not needed to be registered, nonetheless, it is believed that the most typical use of overseas depends on is as part of the tax obligation and economic planning of well-off individuals and their family members.

The smart Trick of Offshore Trust Services That Nobody is Talking About

In an Unalterable Offshore Count on may not be transformed or liquidated by the settlor. An allows the trustee to choose the distribution of profits for different courses of beneficiaries. In a Set depend on, the circulation of revenue to the beneficiaries is repaired as well as can not be transformed by trustee.Confidentiality and anonymity: Regardless of the fact that an overseas count on is formally signed up in the federal government, the events of the trust fund, assets, and the conditions of the count on are not taped in the register. Tax-exempt standing: Properties that are moved to an offshore trust fund (in a tax-exempt offshore zone) are not taxed either when moved to the count on, or when transferred or redistributed to the recipients.

The Ultimate Guide To Offshore Trust Services

This has actually also been done in a number of U.S. states., after that the trustees should take a positive function look at more info in the affairs on the firm., yet continues to be part of depend on legislation in numerous usual regulation jurisdictions.Paradoxically, these specialised forms of depends on seem to infrequently be used in connection with their initial designated uses. STAR trust funds appear to be utilized much more frequently by hedge funds creating common funds as device counts on (where the fund supervisors want to eliminate any kind of commitment to attend conferences of the business in whose protections they invest) and panorama trust funds are regularly utilized as a part of orphan frameworks in bond problems where the trustees want to separation themselves from monitoring the providing automobile.

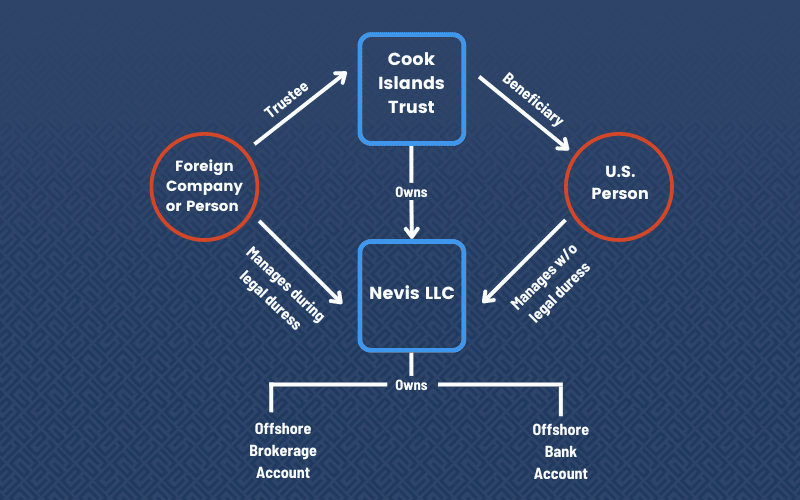

Particular jurisdictions (significantly the Chef Islands, however the Bahamas Has a species of possession protection trust) have actually given unique depends on which are styled as asset protection trust funds. While all counts on have an property defense element, some jurisdictions have passed regulations attempting to make life difficult for lenders to press insurance claims versus the trust fund (for instance, by offering for especially brief constraint durations). An offshore trust is a tool used for asset protection as well as estate planning that works by moving possessions right into the control of a legal entity based in one more nation. Offshore counts on are irreversible, so trust fund owners can not redeem ownership of transferred possessions. They are also complicated as well as costly. For people with higher liability issues, offshore trust funds can offer defense as well as higher personal privacy as well as some tax obligation benefits.

How Offshore Trust Services can Save You Time, Stress, and Money.

Being offshore adds a layer of security and also privacy along with the capability to manage taxes. Because the depends on are not located in the United States, they do not have to follow United state laws or the judgments of U.S. courts. This makes it much more challenging for lenders and plaintiffs to pursue claims against assets held in offshore counts on.It can be challenging for 3rd parties to figure out the properties and also proprietors of overseas trust funds, that makes them help to privacy. In this article order to establish an offshore count on, the very first step is to select a foreign nation in which to situate the trust funds. Some preferred areas consist of Belize, the Chef Islands, Nevis as well as Luxembourg.

The Greatest Guide To Offshore Trust Services

Transfer the possessions that are to be shielded right into the trust - offshore trust services. Offshore trusts can be beneficial for estate planning and also asset security however they have limitations.residents that develop overseas trusts can not leave all tax obligations. Revenues by properties positioned in an overseas trust fund are devoid of U.S. tax obligations. U.S. residents who obtain distributions as recipients do have to pay U.S. revenue tax obligations on the circulations. U.S. owners of overseas depends on also need to submit reports with the Irs.

Rumored Buzz on Offshore Trust Services

Corruption can be a concern in some countries. Additionally, it is necessary to choose a nation that is not likely to experience political agitation, program change, financial upheaval or quick modifications to tax policies that can make an offshore trust much less useful. Property defense depends on typically have actually to be established prior to they are required.They additionally don't perfectly protect versus all claims and might expose try here owners to dangers of corruption as well as political instability in the host nations. Overseas trust funds are helpful estate planning as well as possession security devices. Recognizing the best time to utilize a details depend on, and which trust fund would provide one of the most profit, can be complex.

An Offshore Count on is a traditional Depend on formed under the regulations of nil (or reduced) tax obligation International Offshore Financial. A Count on is a legal tactical plan (comparable to an arrangement) whereby one individual (called the "Trustee") in line with a subsequent person (called the "Settlor") grant recognize and also hold the home to assist different individuals (called the "Recipients").

Report this wiki page